Detalles

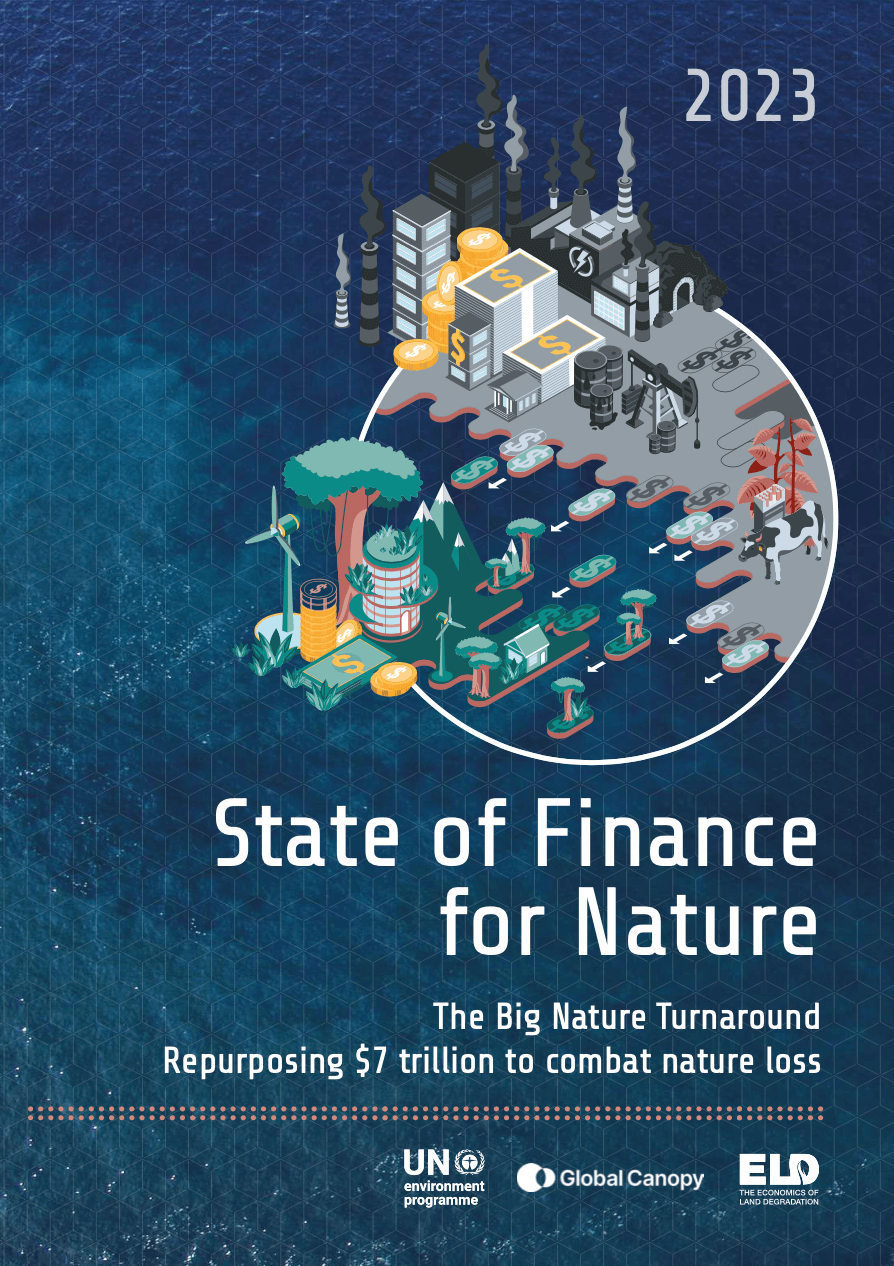

| For the first time, this edition of the report estimates the magnitude of nature-negative financial flows from both public and private sector sources globally. Nature-Based Solutions (NbS) offer critical investment opportunities as they are cost-effective and provide multiple benefits. The report focuses on current levels of NBS implementation and financing, as well as how much finance is needed to achieve specific Rio goals: limiting climate change to 1.5°C, protecting 30% of land and sea by 2030 (30x30 target) and achieving land degradation neutrality (LDN, by 2030. The financing gap for NBS is the difference between current financial flows and financing needs for NBS in the scenario aligned with the Rio objectives. |

Recursos relacionados

2020

ENCORE facilita a bancos e inversores explorar el impacto de sus carteras en el riesgo de pérdida de especies e integridad de los ecosistemas

Basada en el enfoque de los bienes y servicios que provee la naturaleza, la herramienta ENCORE (Exploring Natural Capital Opportunities,…

Sector actions towards a nature-positive future. Mapping the sector priority actions against the recommendations of the Global Biodiversity Framework and the Sustainable Development Goals

Business for Nature, WBCSD and the World Economic Forum have published this companion guide that provides a mapping of priority…

Nature Positive for Business. Developing a common approach

Nature, which encompasses the areas of water, biodiversity, soil/land and air/climate, continues to decline with significant negative impacts on society.…