Nature-related financial risks in our own account investments: An exploratory case study and deep dive in electric utilities

Detalles

| This case study from De Nederlandsche Bank discusses their initial efforts to examine nature-related financial risks in their proprietary investments. The assessment has been carried out using the LEAP (Locate, Assess, Analyze, Prepare) approach of the Task Force on Nature-related Financial Disclosures, the first example of a central bank using this approach to publish an assessment of nature-related risks. The report highlights the range of potential exposures to nature-related risks originating from material impacts or dependencies of nature identified in a substantial proportion of the portfolios examined. A closer look at granular location data shows that physical and transition risks could arise from these sources for many industries and businesses. The analysis also emphasizes, in line with the Network for Greening Financial System's (NGFS) conceptual framework on nature-related risks, the interconnectedness between nature and climate risks. It indicates that reducing climate-related risk may not necessarily lead to a corresponding reduction in nature-related financial risk and therefore advocates an integrated approach to assessing both types of risk. |

Recursos relacionados

Assessment of Biodiversity Measurement Approaches for Businesses and Financial Institutions (Fifth edition)

This report is the fifth edition of the mapping carried out by the European platform Business and Biodiversity on the…

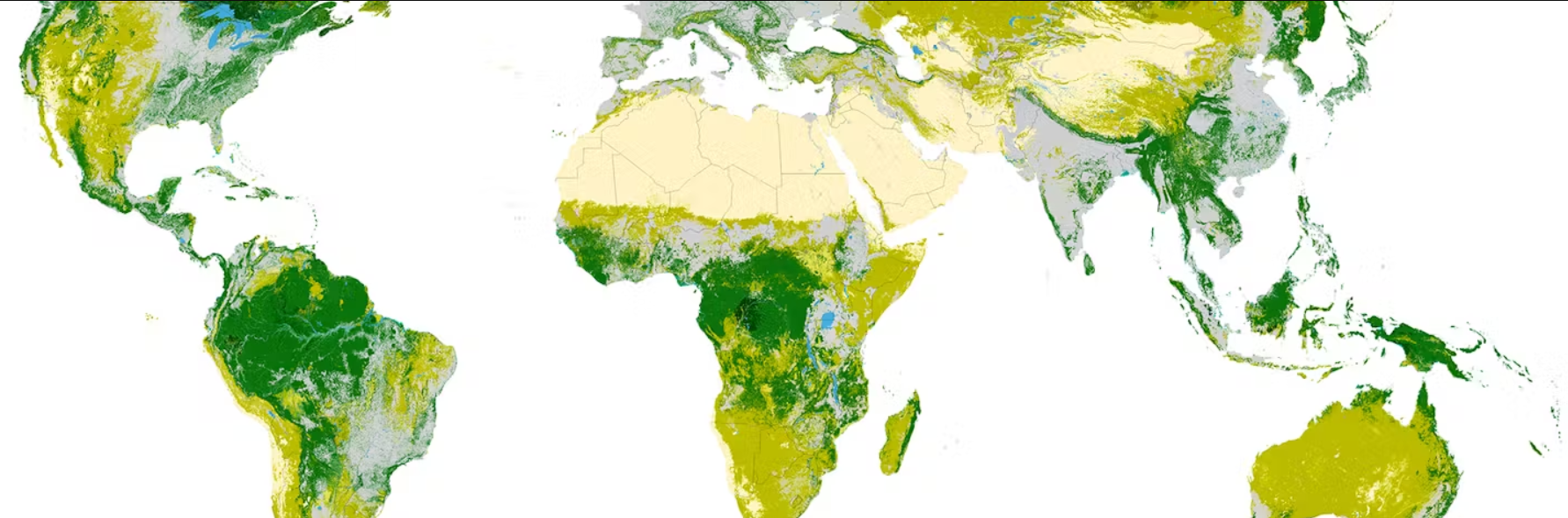

Natural Lands Map Provides Baseline for Companies’ No Conversion Targets

This new tool aims to help companies that source raw materials from natural terrestrial ecosystems to change the way they…

Global Corporate Sustainability Report 2024

The OECD's Global Corporate Sustainability Report aims to encourage the adoption of corporate governance policies that promote sustainability and resilience…