Detalles

| This report describes the valuable insights gained and significant findings derived from a global pilot project initiated by UNEP FI in collaboration with 20 financial institutions. The purpose of this pilot, conducted from May to June 2023, was to assess the current needs and challenges for initiating reporting on nature-related risks, based on the TNFD (Task Force on Nature-related Financial Disclosures) framework. This pilot aimed to specifically assess an integrated climate and nature approach to sustainability reporting, examining the existing synergies between the TCFD-TNFD frameworks and climate and nature scenarios. UNEP FI is one of the founding partners and collaborators in the implementation of the TNFD. Following the publication of the TNFD Recommendations in September 2023, UNEP FI will continue to play this supporting role in 2024 through its now renamed TNFD Implementation Programme. Through this programme, UNEP FI is actively assessing the support of the private financial sector to support the efforts of early adopters of the TNFD towards advancing the mission of the TNFD, i.e. enabling business and finance to integrate nature into decision-making and support a shift in global financial flows away from negative outcomes for nature and towards positive outcomes for nature. |

Recursos relacionados

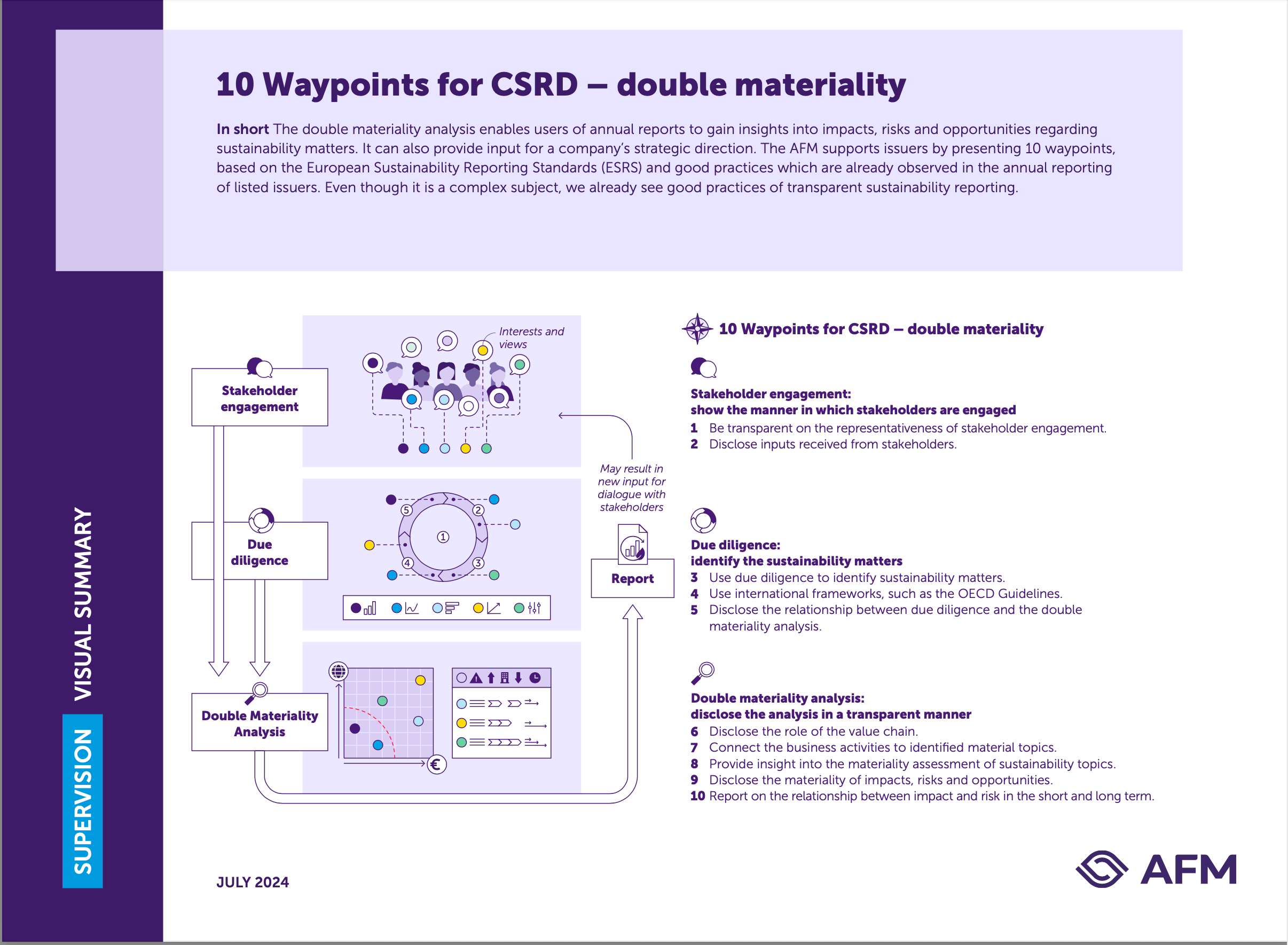

10 Waypoints for CSRD – double materiality

Dual materiality analysis plays a key role in the Corporate Sustainability Reporting Directive (CSRD ) that came into force for…

2023

Chemical sector guidance on applying the natural capital management accounting methodology

Como parte del Proyecto Transparente, este documento de orientación sectorial proporciona una descripción general y recursos adicionales en apoyo de…

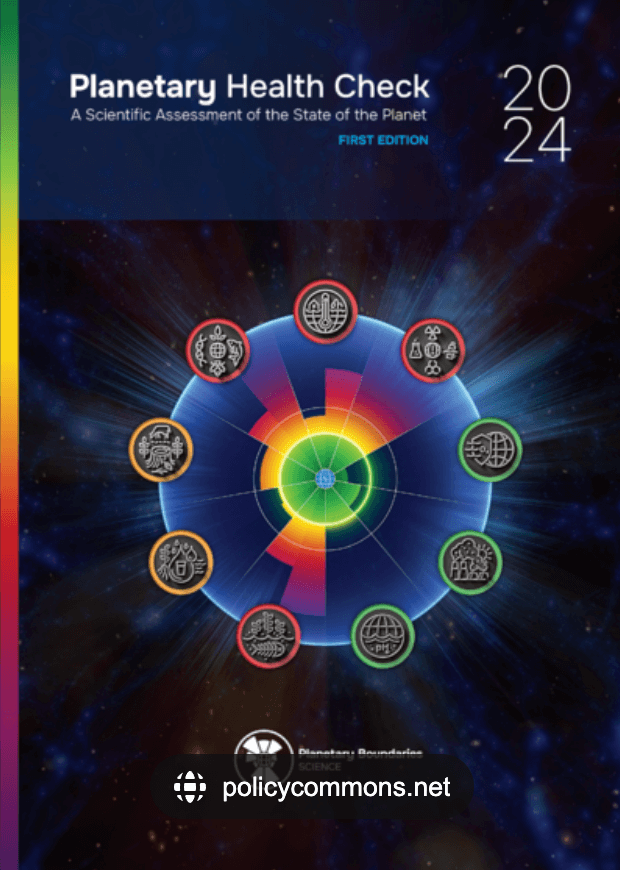

Planetary Health Check 2024

The Planetary Boundaries framework defines a science-based "safe operating space for humanity" to prevent dangerous, abrupt or irreversible large-scale environmental…