Global Survey of Nature Risk Management at Financial Firms. 2024: A Discipline in Its Infancy

Detalles

| Nature loss has a profound impact on the economy and is a source of significant risk for financial institutions. In addition, nature's resilience is vital in the battle against climate change. Since natural hazard management is in its early stages, there is still a lot of work to be done. To better understand how risks and opportunities are managed in today's economic landscape, GARP conducted its first global study on managing nature-related financial risks in financial companies. Surveying a total of 48 companies, GARP's new report offers a useful snapshot of current risk management practices across the financial services industry, while helping companies prioritize areas for improvement along their natural hazard journey. |

Recursos relacionados

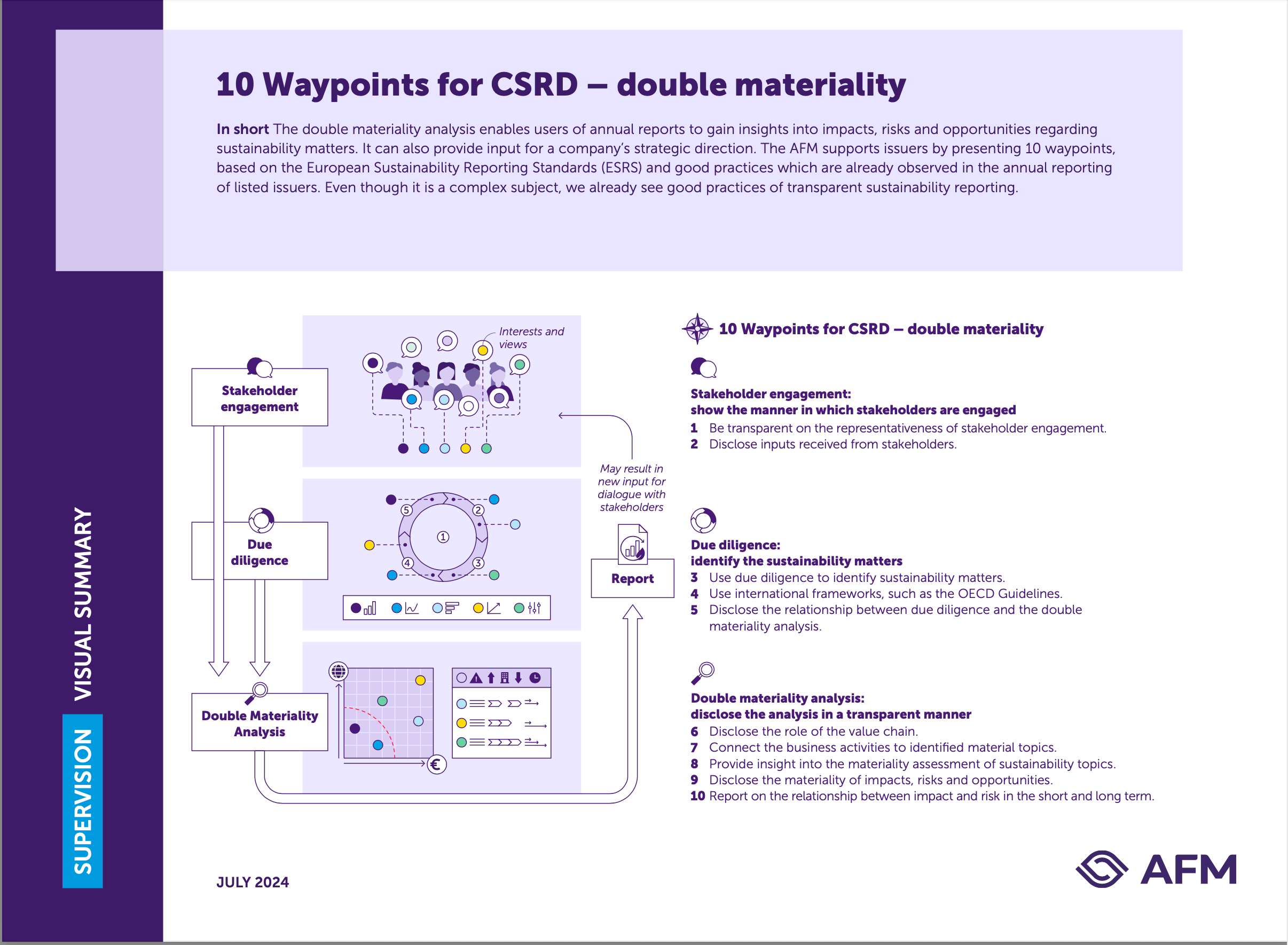

10 Waypoints for CSRD – double materiality

Dual materiality analysis plays a key role in the Corporate Sustainability Reporting Directive (CSRD ) that came into force for…

Final Report: Technical Standards on the European Green Bonds Regulation

This final report summarises the contributions received following the consultation carried out by the European Securities and Markets Authority (ESMA)…