The importance of nature for the financial sector

The Spanish Business and Biodiversity Initiative (IEEB) and Spainsif (Spanish Forum for Sustainable Investment and Finance) have launched the “Nature and Finance” cycle with the aim of raising awareness and training the financial sector on how to take nature into account in investment and financing decisions.

This cycle, developed within the framework of the Recovery, Transformation and Resilience Plan (RTRP), financed by the European Union – NextGenerationEU, began on October 9 with a first session where the importance of nature for the financial sector was raised.

The inauguration was carried out by Félix Romero, director of the Biodiversity Foundation of the Ministry for Ecological Transition and the Demographic Challenge, who stressed that “the arrival of an active financial sector that can accelerate and inject a greater volume of investment in favor of nature is absolutely necessary.” The close link between nature, economy and well-being creates the need to “match development with the limits of natural capital itself,” he said, paying special attention to the market failures of the current economic model that mean that “the services provided by nature often lack value in the income statements.”

He also warned of the risks to economic and financial stability derived from the alarming state of degradation of nature, adding that “in Spain, we have recently experienced DANAS and large fires, making it clear that the risk of mismanagement of our territory reverts to our own economic model”. He also addressed how investing in nature creates significant opportunities. “Nature-based solutions or nature credits are already on the table,” he said, encouraging “moving forward together and joining the efforts of the private sector” to undertake investments and make capital flow towards positive solutions for nature.

The meeting was moderated by Claudia González, Senior Associate at Green Finance Institute Spain, and brought together representatives from the academic, regulatory and institutional spheres. The first intervention, by Alexandra Pinzón-Torres, Nature Positive Lead at Global Canopy, addressed key concepts for the financial audience such as the materiality of nature for finance, underlining the dependence (high or moderate) of more than half of the world’s GDP on the services provided by nature.

Noelia Jiménez, senior economist at the Bank of Spain, showed the links between nature and financial stability from the perspective of banking supervision. According to the World Economic Forum, five of the ten biggest global risks for the next decade are directly linked to the loss of natural capital, with far-reaching economic and financial implications that threaten both the stability of markets and the resilience of economies.

In Europe, supervisors have begun to act through stress tests and improved information on risk exposure. The Bank of Spain is also promoting specific analyses – such as those related to water and desertification – and international collaborations to integrate environmental risks into financial stability.

Professor Adrián García, from the Rey Juan Carlos University, presented the priorities for financing and investment in nature in Spain, framed in the Strategic Plan for Natural Heritage and Biodiversity 2030 and the State Strategy for Green Infrastructure, Connectivity and Ecological Restoration.

The transition from conservation to investment involves incorporating nature into economic and territorial planning, and into the definition of infrastructures and services. Tools such as the United Nations System of Integrated Environmental and Economic Accounting (EEAS) to link ecosystem health with economic activity, and urban ecosystem accounting to incorporate the value of natural capital into urban planning, would promote investments that respect planetary boundaries and strengthen socio-ecological resilience.

On the international side, Julen González, technical director of the Finance for Biodiversity Foundation, presented the global initiatives and alliances that promote the integration of nature in the financial sector. Among them, he presented the Finance for Biodiversity Pledge, which has more than 200 signatory entities representing 23 trillion euros in assets. This collective commitment urges global leaders to reverse biodiversity loss by 2030 and to integrate nature into financial decisions.

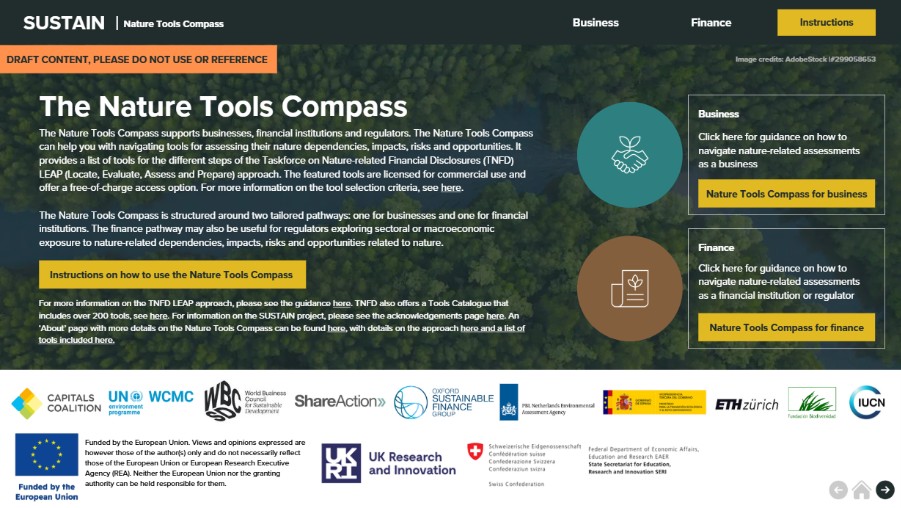

The fulfilment of these commitments is supported by widely recognised frameworks and tools, such as the Natural Capital Protocol, the Taskforce on Nature-related Financial Disclosures (TNFD) or the Science-Based Targets for Nature (SBTN) that facilitate the systematic assessment of risks related to nature loss, the identification of opportunities and the development of metrics and benchmarks at the level of companies and sectors. promoting an international consensus on performance indicators.

Andrea González, CEO of Spainsif, closed the session by announcing a second session, focused on tools to integrate nature into decision-making in the financial sector, which will be held on 4 December 2025. The “Nature and Finance” cycle will continue with new sessions dedicated to case studies, public policies, advanced tools and trends.

The full recording of the session is available at this link.

The presentations used by the panelists are available on https://www.spainsif.es/wp-content/uploads/2025/10/Presentaciones-Ciclo-1-FinyNatura.pdf