Assessing nature-related issues of key value chain clients in a Brazilian Asset Manager’s portfolio

Detalles

| JGP Asset Management participated in the Global Canopy Taskforce on Nature-related Financial Disclosures (TNFD) pilot program prior to the release of the TNFD's final recommendations in September 2023. The TNFD has developed a series of recommendations and guidelines for organizations to identify, assess, manage and, where appropriate, disclose their dependencies, impacts, risks and opportunities in relation to nature. Its recommendations and guidance help organizations integrate nature into decision-making and ultimately support a shift in global financial flows from nature-negative to nature-positive outcomes. With the support of Frontierra and Global Canopy, JGP Asset Management piloted the TNFD's LEAP approach to identifying and assessing its nature-related issues. The pilot project focused on the application of the LEAP approach to assess JGP Asset Management's exposure to tropical deforestation through companies related to the agricultural sector in its investment portfolio. |

Recursos relacionados

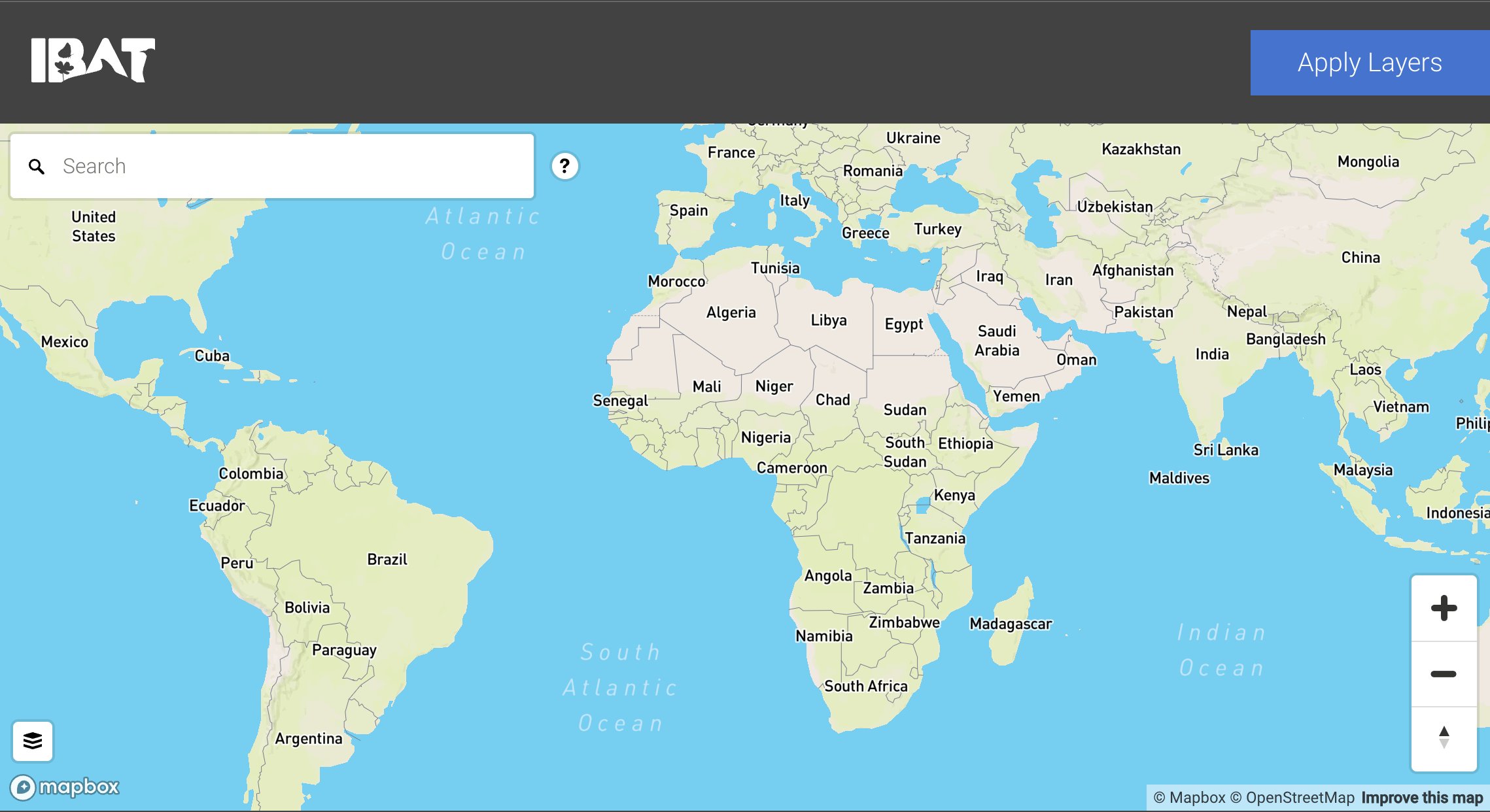

Integrated Biodiversity Assessment Tool’s biodiversity map

The TNFD and the Integrated Biodiversity Assessment Tool (IBAT) have collaborated to create an integrated and publicly accessible version of…

Navigating sustainability in agri-food supply chains. A review of sustainable supply chain business guidelines for the agri-food secto

Guidelines for sustainable supply chains are crucial to guide industry practices on environmental responsibility, social equity, human rights and long-term…

European Union 8th Environment Action Programme: Monitoring report on progress towards the 8th EAP objectives 2024 edition

The EEA assessment sets out the framework for the EU's environmental policy until 2030. Progress is assessed against a set…