Stocktake on Nature-related Risks: Supervisory and regulatory approaches and perspectives on financial risk

Detalles

| A growing number of financial authorities have been considering the potential implications of nature-related risks, including nature degradation and biodiversity loss. In February 2024, the G20 Finance Ministers and Central Bank Governors asked the FSB to take stock of regulatory and supervisory initiatives associated with identifying and assessing nature-related financial risks, including investigating central banks' and supervisors' perceptions of whether nature degradation, such as biodiversity loss, is a relevant financial risk. The balance sheet summarises current and planned regulatory and supervisory initiatives, and presents key challenges for authorities in identifying, assessing and managing nature-related financial risks. The report also includes some case studies on initiatives by international authorities and organizations (the Network for Greening the Financial System (NGFS), the World Bank, the Organization for Economic Co-operation and Development (OECD), the Working Group on Nature-related Financial Disclosures (TNFD), De Nederlandsche Bank (DNB). |

Recursos relacionados

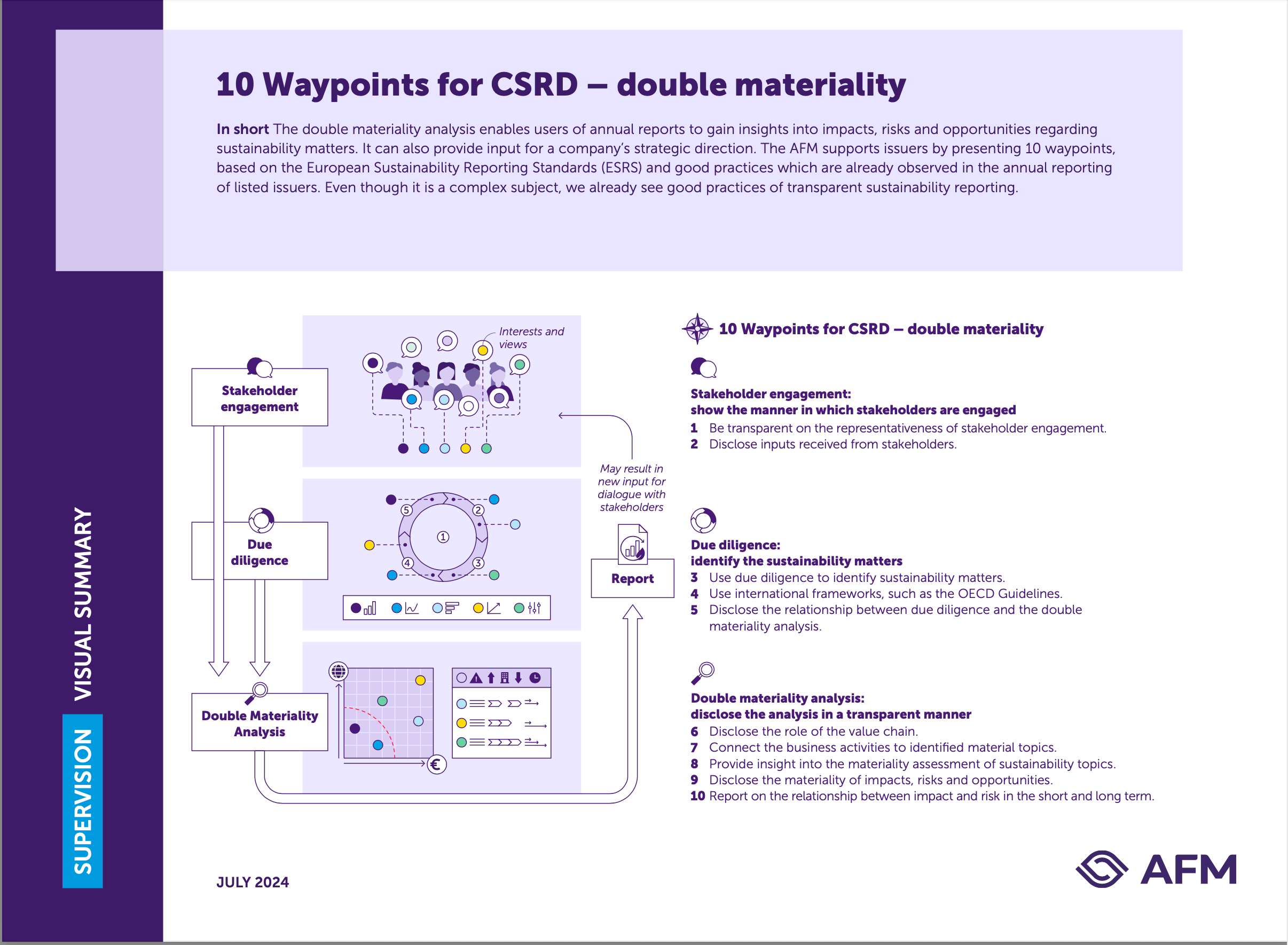

10 Waypoints for CSRD – double materiality

Dual materiality analysis plays a key role in the Corporate Sustainability Reporting Directive (CSRD ) that came into force for…

New and updated resources to help companies implement IFRS S1 and IFRS S2 from 2024 onwards

Ahead of the ISSB Standards (IFRS S1 and IFRS S2) coming into force in January 2024, the International Sustainability Standards…

Financing Our Survival: Building a Nature-Positive Economy through Subsidy Reform

New research by Business for Nature shows that environmentally harmful subsidies (SDMs) are subsidies or incentives that unintentionally encourage unsustainable…