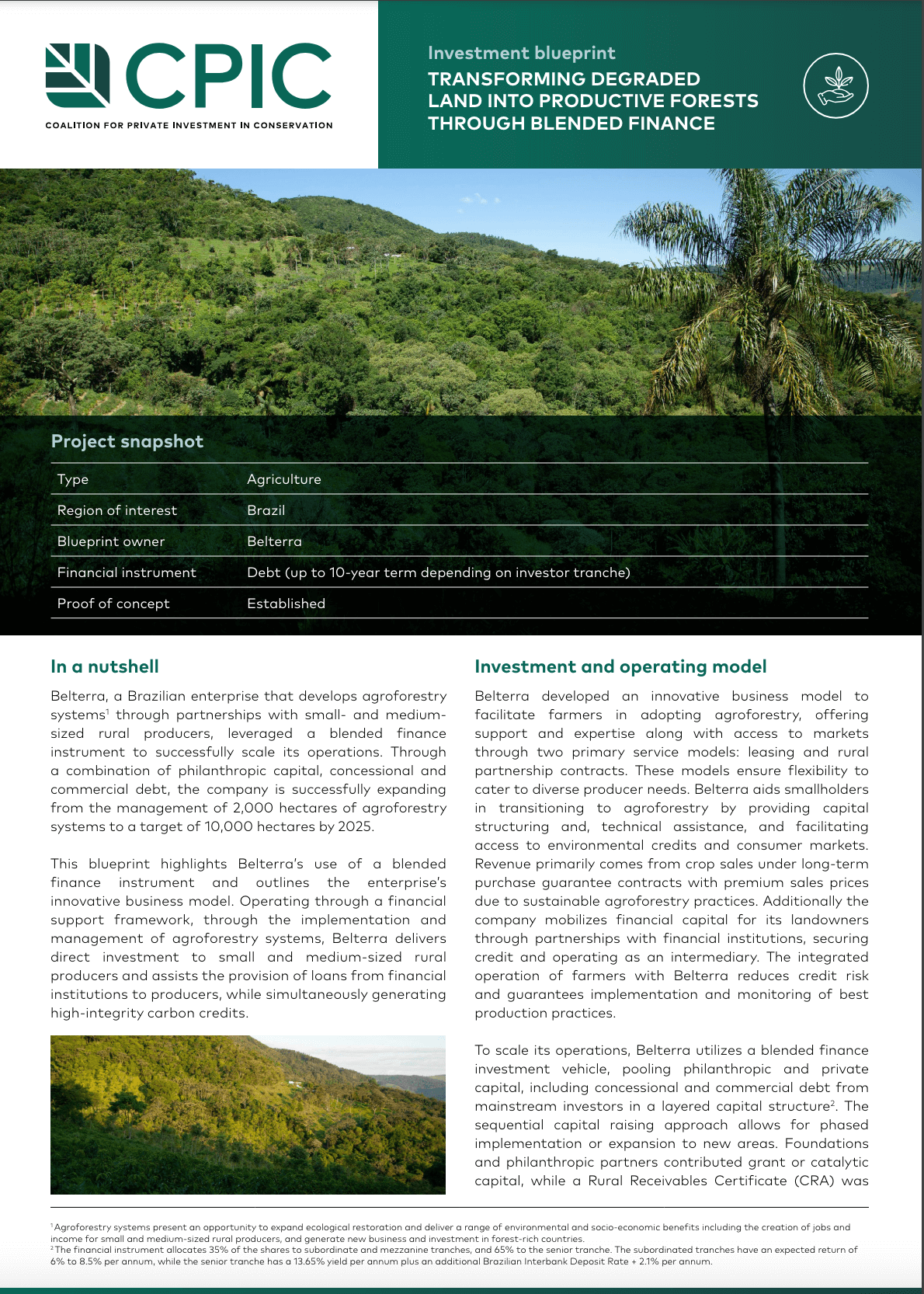

Transforming degraded land into productive forests through blended finance in Brazil

Detalles

Belterra, a Brazilian company that develops agroforestry systems through partnerships with small and medium-sized rural producers, leveraged a blended finance instrument to successfully expand its operations.

Through a combination of philanthropic capital and commercial debt and on concessional terms, the company is successfully moving from the management of 2,000 hectares of agroforestry systems to a target of 10,000 hectares by 2025.

This blueprint highlights Belterra's use of a blended finance instrument and outlines the company's innovative business model. Operating through a framework of financial support, through the implementation and management of agroforestry systems, Belterra offers direct investment to small and medium-sized rural producers and helps provide loans from financial institutions to producers, while generating high-integrity carbon credits.

Impact measurement

To assess the impact of its operations, Belterra uses IRIS+, a catalog of performance metrics used by impact investors to measure a company's impact based on key indicators related to biodiversity and ecosystems, economy and society, risk management, and governance. Key biodiversity and ecosystem indicators include the area of land reforested, the area under ecological restoration management and the total area of protected land.

Recursos relacionados

Nature risk profile

The Task Force on Nature-Related Financial Disclosures (TNFD) is providing much-needed clarity on how organizations can begin to incorporate nature-related…

Serie de vídeos educativos sobre los borradores de las Normas para la Elaboración de Informes de Sostenibilidad

Serie de vídeos educativos sobre el primer conjunto de proyectos de Normas Europeas para la Elaboración de Informes de Sostenibilidad…