Nature Finance and Biodiversity Credits: A Private Sector Roadmap to Finance and Act on Nature

Detalles

Companies can start contributing to the nature positive objective by defining a nature strategy and the corresponding nature finance action plan.

To halt and reverse biodiversity loss by 2030, closing the annual $700 billion annual nature financing gap is essential.3 In addition to the necessary government action, the private sector has a critical role to play in mobilizing the necessary financing. To support businesses in these efforts, this roadmap outlines the steps needed to develop and implement a nature strategy and nature finance action plan. While focusing on biodiversity credits, the considerations included in this roadmap are broadly applicable to other nature finance mechanisms, such as payments for ecosystem services (PES), green bonds, or nature-linked loans.

Recursos relacionados

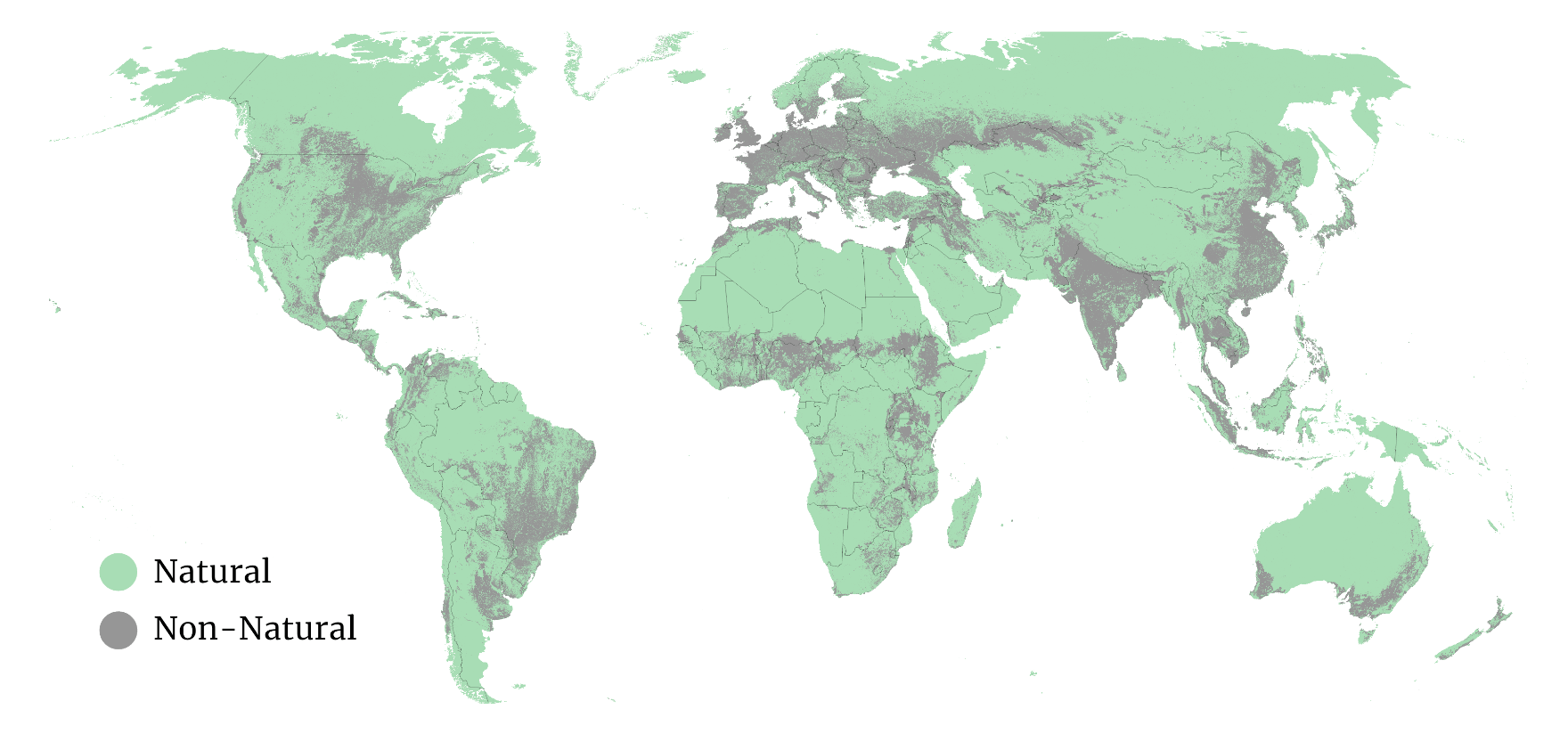

Natural Lands Map

Natural lands around the world are being converted and degraded at unprecedented levels. Three-quarters of the land has been significantly…

Every Job is a Nature Job – Business Development

This report offers recommendations for professionals who want to ensure that nature is taken into account when identifying opportunities and…