Detalles

| The authors of this report reveal that the degradation of nature could cause a loss of 12% of British GDP. The damage caused to the natural environment is slowing down the British economy and could lead to an estimated 12% reduction in GDP in the coming years, greater than the impact on GDP of the global financial crisis or Covid-19. By comparison, the 2008 financial crisis subtracted around 5% from the value of British GDP, while the Covid-19 pandemic cost the UK up to 11% of its GDP in 2020. This pioneering analysis quantifies the impact that nature degradation, both nationally and internationally, could have on the UK's economy and financial sector. These risks must be recognised and addressed in order to strengthen the UK's economic and financial resilience. The analysis shows that nature-related risks are as detrimental to the economy as those arising from climate risks. However, while the economic costs of climate change are increasingly accepted, the risks posed by the degradation of nature represent a material cost that has not been sufficiently taken into account in financial and business decision-making. This is leaving the economy and the financial sector exposed, while these risks continue to rise unchecked. The United Kingdom is one of the world's most degrading countries in nature: three-quarters of its territory has a high level of ecosystem degradation, with consequent risks to financial services and the economy in general. The analysis shows, however, that half of the UK's nature-related financial risks originate overseas. The work has been led by the Green Finance Institute (GFI), with a technical team involving the UK's top researchers: the Environmental Change Institute at the University of Oxford, the University of Reading, the United Nations Environment Programme's World Conservation Monitoring Centre (UNEP-WCMC) and the National Institute of Economic and Social Research (NIESR). |

Recursos relacionados

Additional sector guidance – Aquaculture

This document provides additional guidance in the aquaculture sector. This covers: The assessment of nature-related issues using the TNFD's LEAP…

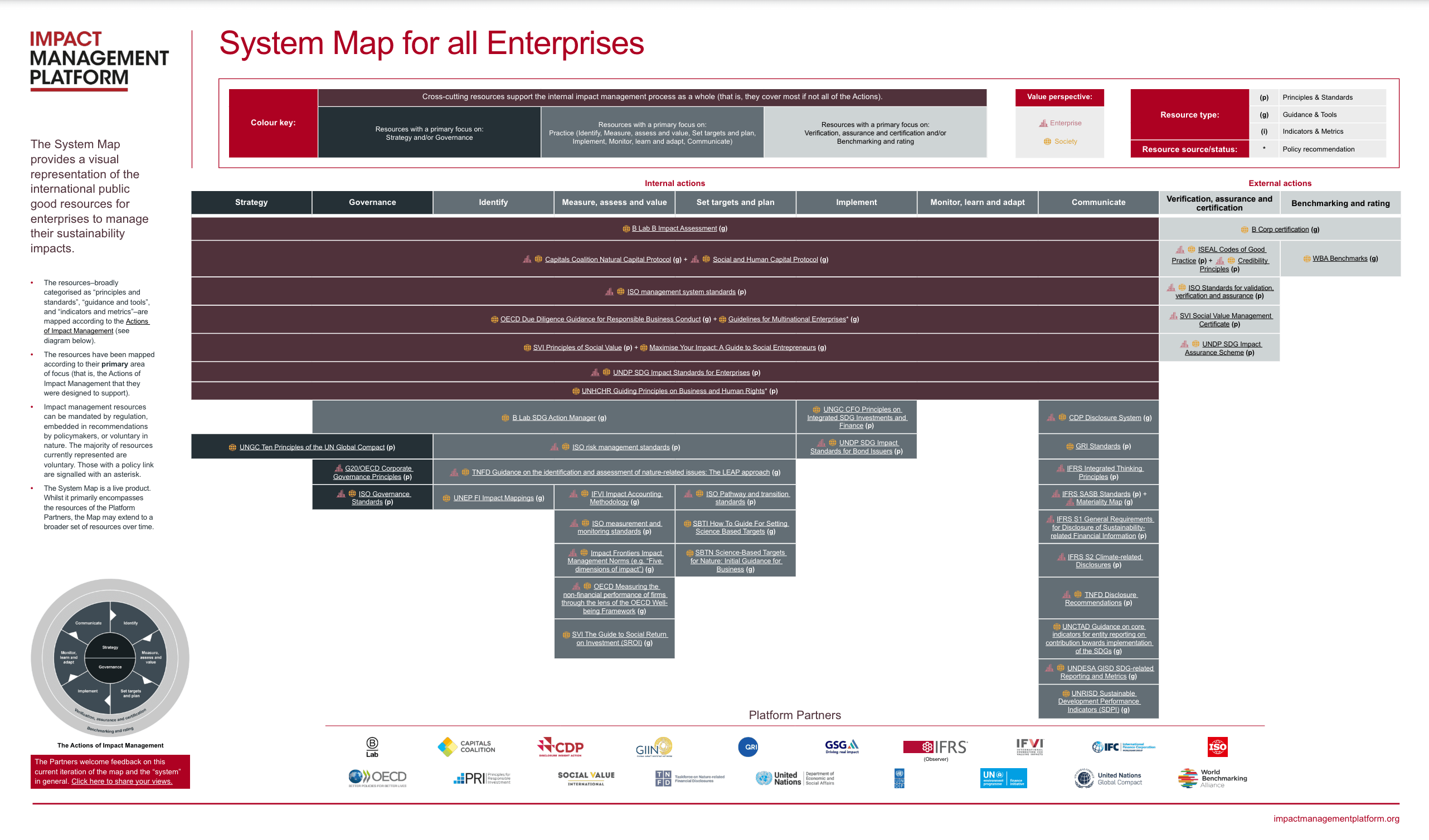

The System Map

The System Map has just received an update. It is a tool to help organizations, investors, and financial institutions manage…

Manual for green public procurement of the General State Administration

The Ministry for the Ecological Transition and the Demographic Challenge (MITECO) has published the Manual for Green Public Procurement of…