Detalles

| For the first time, this edition of the report estimates the magnitude of nature-negative financial flows from both public and private sector sources globally. Nature-Based Solutions (NbS) offer critical investment opportunities as they are cost-effective and provide multiple benefits. The report focuses on current levels of NBS implementation and financing, as well as how much finance is needed to achieve specific Rio goals: limiting climate change to 1.5°C, protecting 30% of land and sea by 2030 (30x30 target) and achieving land degradation neutrality (LDN, by 2030. The financing gap for NBS is the difference between current financial flows and financing needs for NBS in the scenario aligned with the Rio objectives. |

Recursos relacionados

Roadmap to Nature Positive: Foundations for the energy system

This roadmap provides a structured approach to assessing nature's impacts and dependencies along the energy sector's value chain.

Guidelines on the names of funds that use the term ESG or sustainability-related terms Guidelines on the names of funds that use the term ESG or sustainability-related terms

ESMA has published the translation of its Guidelines on the use of ESG and sustainability-related terms in fund names. The…

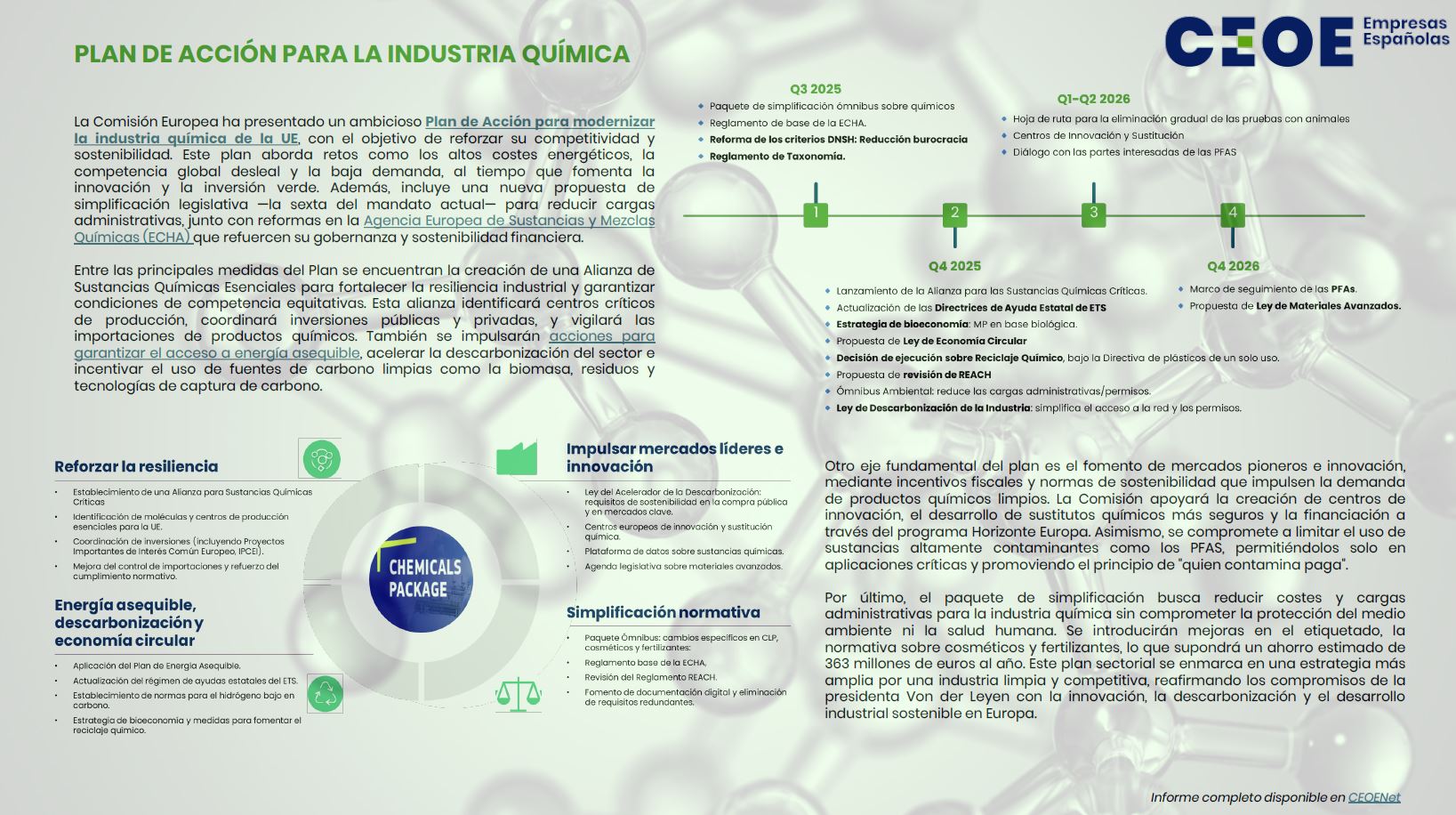

CEOE summary report on the Action Plan for the chemical industry

Factsheet of the Action Plan to modernise the chemical industry presented by the European Commission in July. The report includes…