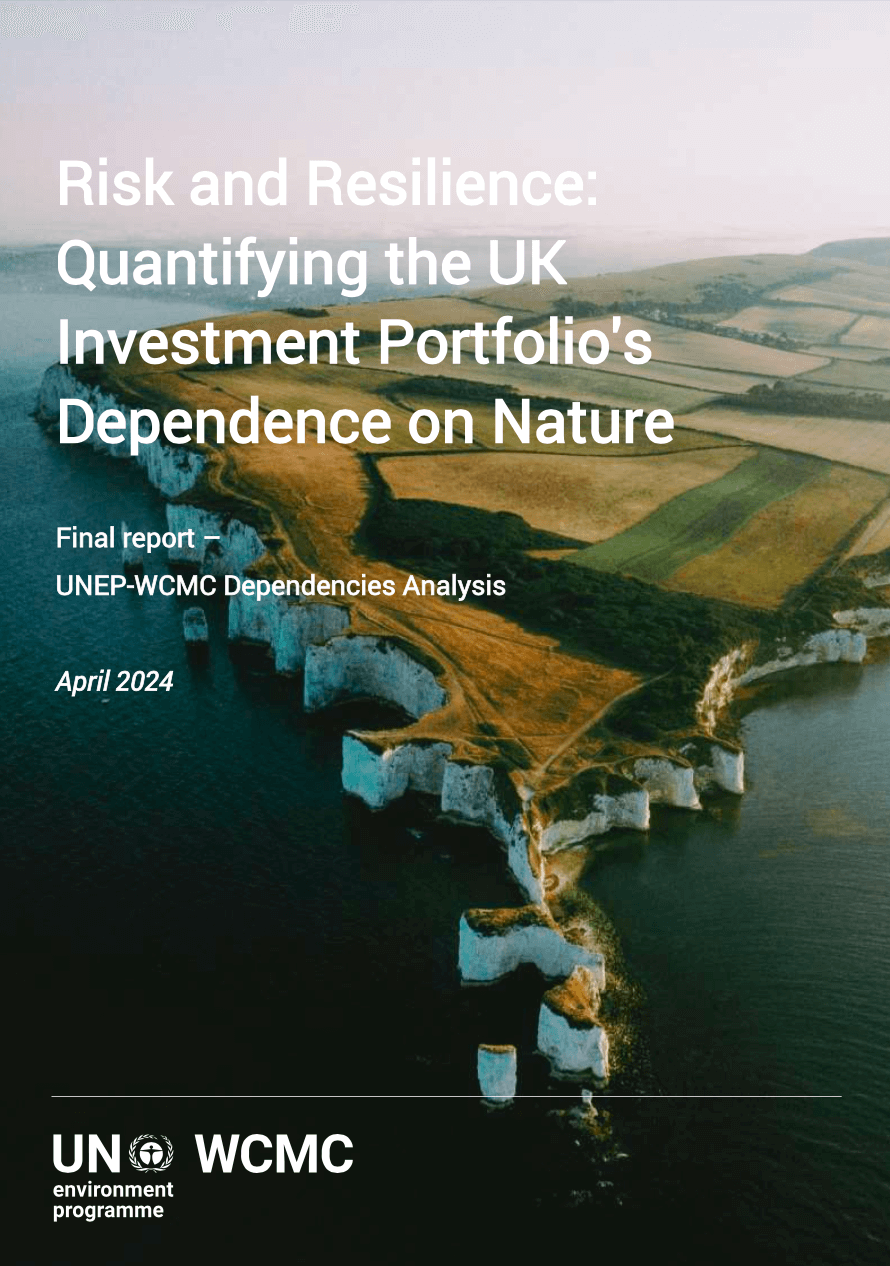

Risk and Resilience: Quantifying the UK Investment Portfolio’s Dependence on Nature

Detalles

| There are material dependencies of nature throughout the UK's financial investment portfolio. Until now, the ecosystem services provided by natural capital assets have not been accounted for on balance sheets, so they are often overlooked. However, we found that at least 10% of the UK's bond, equity and loan portfolio is directly heavily or heavily dependent on nature and its services. In addition, £2.5 trillion or 44% of upstream financial exposures are associated with NACE divisions with a high or very high dependence on nature and areas of the world with a rapid rate of natural capital depletion, exposing this 44% to considerable potential nature-related risk. This should be a wake-up call for financial institutions and policymakers to take steps to better understand the British economy's dependencies on the natural world and the risks that stem from them. |

Recursos relacionados

Double materiality. The guiding principle for sustainability reporting

With an ongoing shift towards mandatory sustainability reporting, GRI is supporting global policymakers with an initial set of three new…

2022

Webinario Align 12 de julio – Resumen

Además del resumen de este webinario, puedes ver la grabación en este enlace, y la presentación en este otro enlace.